In an increasingly digital world, businesses and freelancers alike have access to a global marketplace at their fingertips, creating potential for significant online earnings.

However, in an era characterized by economic uncertainties and rapid technological changes, it’s essential to funnel these digital agency or freelance profits into investments. The act of investing not only helps to safeguard these earnings from inflation and other economic downturns, but also creates opportunities for further wealth generation. By strategically reinvesting earnings, digital agencies and freelancers can cultivate financial resilience, ensuring long-term business sustainability and personal financial security. Diversification in the form of investments can thus transform one-time profits into a continually growing source of income.

Why Run a Digital Agency or Work as a Freelancer?

A digital agency is a business that delivers creative, strategic, and technical development of products and services in the digital space. This can encompass a wide range of services, including content marketing, social media marketing, search engine optimization (SEO), pay-per-click advertising (PPC), web design, and development.

Freelance work, on the other hand, involves individuals offering similar services on a contract basis, often specializing in one or a few of these areas. These professionals may work independently or through various online platforms that connect them with clients. The digital nature of these services allows for remote work, often leading to a global client base and the potential for a flexible work schedule.

As more businesses move online, the demand for these services is rapidly growing. This creates a lucrative opportunity for digital agencies and freelancers to earn substantial income online, with the advantage of low overhead costs, the ability to scale operations, and the potential for multiple income streams from various clients.

The Need for Financial Stability and Growth

In today’s volatile economic environment, digital agencies and freelancers aren’t immune to the uncertainties that can significantly impact their earnings. Economic events such as recessions, market crashes, or sudden changes in regulations can cause fluctuations in income, client demand, and overall business profitability.

Investing serves as a crucial strategy to mitigate these risks. Here’s how:

- By creating a diversified portfolio, you can offset potential losses in one area with gains in another.

- Investing in assets like stocks, bonds, or real estate can provide additional income streams that can cushion the impact of a bad month or quarter in your primary business.

- It acts as a hedge against inflation, ensuring that your money doesn’t lose value over time due to rising prices.

Real-life examples underline the importance of this strategy. Consider the impact of the COVID-19 pandemic, where many businesses faced reduced revenues or even closures. Those with diversified income streams, particularly investments, were better able to weather this storm. Similarly, during the 2008 financial crisis, freelancers and agencies who had invested wisely found that their investments served as a financial safety net when client work was scarce. Hence, funneling digital earnings into investments is not just a growth strategy—it’s a survival strategy, vital for ensuring financial stability in the face of economic upheaval.

The Power of Reinvestment

The power of reinvestment cannot be overstated when it comes to growing digital agency or freelance profits. By taking earnings and investing them back into the business, or into other financial instruments, one can significantly amplify their wealth.

At any time, investments can be converted to cash and used on the business. Reinvestment can fuel business growth by allowing for the acquisition of new tools, training, or personnel that can improve service offerings and attract more clients. It also presents opportunities to venture into new markets, diversify service offerings, or scale operations, all of which can boost profits.

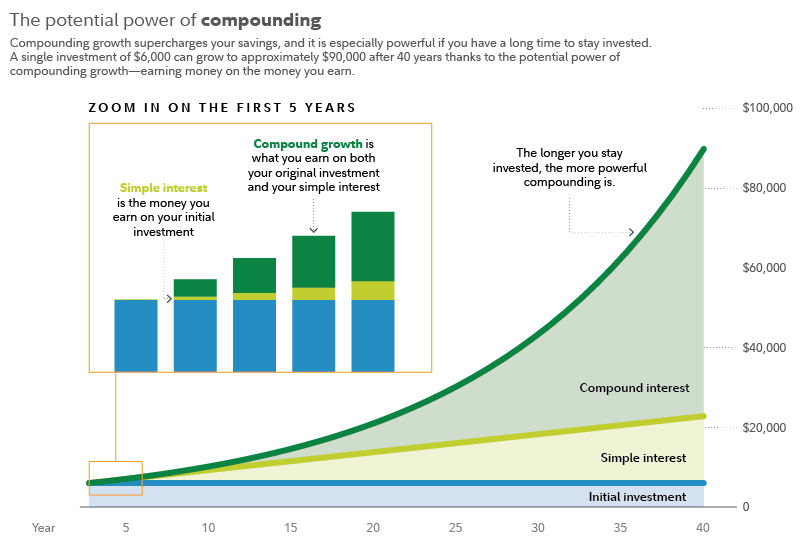

One of the major benefits of reinvestment is the magic of compound interest. It’s a powerful force that can massively benefit digital agencies and freelancers in the following ways:

- Compound interest is essentially ‘interest on interest’. It accelerates wealth creation because the returns generated on your investments are reinvested and generate their own returns.

- Over time, this leads to exponential growth of your capital, meaning the longer your money is invested, the more potential it has to grow.

Several case studies highlight the power of successful reinvestment strategies. For instance:

- Many successful digital agencies have invested their initial profits into expanding their team or acquiring more advanced technology, leading to increased productivity and, subsequently, more substantial profits.

- Freelancers, too, have seen success by reinvesting their earnings into skill development courses or marketing efforts, which have led to higher-paying projects and greater visibility, respectively.

Thus, reinvestment is a powerful tool for wealth accumulation, providing a strong case for funneling digital agency or freelance profits into strategic investments.

Diversification as a Means of Risk Management

In the world of investment, diversification is a risk management strategy that involves spreading investments across various financial instruments, industries, and other categories to optimize returns and reduce the impact of a single poor performing investment. In simpler terms, it’s the financial equivalent of not putting all your eggs in one basket.

Diversification can protect and grow profits in a number of ways:

- It reduces risk: According to a report by the American Economic Association, a well-diversified portfolio can reduce portfolio risk by up to 40%. This is because different investments are affected by different economic events. If one sector is underperforming, another might be doing well, offsetting potential losses.

- It allows for more consistent performance: Diversification can help to level out the highs and lows in your investment portfolio, leading to more consistent returns over time.

- It provides opportunities for higher returns: By investing in a variety of assets, you open up more opportunities to benefit from high-performing investments.

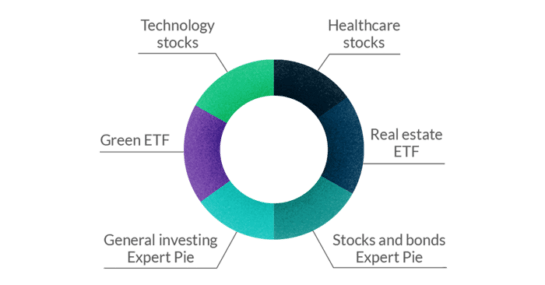

As a digital agency or freelancer, diversifying your investment portfolio can be done in several ways:

- Asset Diversification: This involves spreading your investments across different types of assets, such as stocks, bonds, real estate, and even digital assets like cryptocurrencies. For example, you might have 50% of your investments in stocks, 30% in bonds, and 20% in real estate.

- Sector Diversification: This entails investing across different sectors like technology, healthcare, finance, and consumer goods. An investor might spread their stock investments across these sectors to protect against sector-specific risks.

- Geographical Diversification: This means spreading your investments across different geographic markets to protect against country or region-specific risks. For example, you could invest in companies based in North America, Europe, and Asia.

By implementing a diversified investment strategy, digital agencies and freelancers can not only protect their profits against market volatility but also potentially enhance their financial growth.

Long-term Benefits of Investing Online Earnings

Investing online earnings from a digital agency or freelance work carries numerous long-term benefits. Firstly, it offers financial security. With a well-managed investment portfolio, one can create a financial safety net. This security extends to business operations as well, providing sustainability during economic downturns or periods of lower client demand.

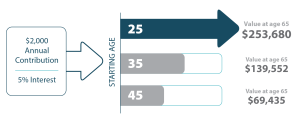

Moreover, investing can pave the way to financial independence. By diligently investing and managing their portfolio, digital agencies and freelancers can generate sufficient passive income to cover their living expenses, thus reducing their dependence on a regular paycheck. This also ties into retirement readiness. With traditional employee retirement benefits often unavailable, investing becomes an even more critical avenue for freelancers to secure a financially stable retirement.

There are many success stories of digital agencies and freelancers who have successfully invested their earnings:

- Consider the case of a small digital marketing agency that began investing its profits into real estate. Over time, the rental income from these properties has grown to match the agency’s operational profits, providing a substantial secondary income stream.

- Another example is a freelance graphic designer who invested early in a diversified portfolio of stocks, bonds, and mutual funds. Despite the ups and downs of the market, her portfolio has grown significantly over time, allowing her to achieve financial independence and plan for an early retirement.

- Finally, a freelance writer who started investing his earnings in a retirement account is now on track to retire comfortably, despite not having access to a traditional employer-sponsored retirement plan.

These stories underline the potential of investing for anyone earning income in the digital space. By leveraging their profits and investing wisely, digital agencies and freelancers can ensure long-term financial stability, independence, and even prosperity.

How to Start Investing Your Online Earnings

Investing your online earnings can be a rewarding endeavor, but it requires careful planning and understanding. Here are some tips to get you started:

- Setting Financial Goals: The first step in investing is to clearly define your financial goals. Are you investing for long-term growth, retirement, or a specific financial target like buying a house? Your goals will determine your investment strategy.

- Understanding Risk Tolerance: This refers to the degree of uncertainty you are willing to tolerate in your investment returns. Everyone’s risk tolerance is different and depends on factors like age, income level, financial goals, and personal comfort with uncertainty. A good rule of thumb is that the higher the potential returns, the higher the risk.

- Don’t Hesitate: Getting started early is essential. With the same annual contribution amount, you can generate much higher returns by starting early.

Once you’ve established your financial goals and risk tolerance, you can explore different investment options. Here are some suitable for digital agencies and freelancers:

- Stocks and Bonds: These are traditional forms of investments. Stocks represent ownership in a company while bonds are essentially loans made to a company or government. They are typically more suitable for long-term investment goals.

- Mutual Funds and ETFs: These are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They provide diversification without the need to purchase each security individually.

- Real Estate: Investing in properties, either through direct purchase or real estate investment trusts (REITs), can be a good way to generate passive income and capital appreciation.

- Retirement Accounts: As a freelancer, you might not have a traditional employer-sponsored retirement plan, but you can still invest in individual retirement accounts (IRAs) or a solo 401(k) for tax-advantaged retirement savings.

- Bitcoin and Crypto: Bitcoin is a decentralized digital currency, separate from governments and fiat currencies. All cryptocurrencies operate on technology called blockchain, which is a decentralized system spread across multiple computers to record and manage transaction data. Investing in cryptocurrencies is often speculative due to their volatility, but they are also seen as a potential hedge against traditional financial market fluctuations.

While starting to invest, it’s advisable to seek professional financial advice. Financial advisors can provide personalized advice based on your financial situation and goals. They can also help you navigate complex investment topics. However, be sure to choose a reputable advisor, preferably one who is a fiduciary, meaning they are legally obligated to act in your best interest.

Additionally, self-education is a crucial part of investing. There are numerous resources available online, including investment courses, financial news sites, podcasts, and books. Educating yourself about investing can help you make informed decisions and stay abreast of market trends. Remember, investing is a journey, not a destination. It takes time, patience, and continual learning to achieve your financial goals.

Conclusion & Our Investment Tips Infographic

Investing the profits from your digital agency or freelance work is not just a smart financial move; it’s a critical strategy for long-term growth, sustainability, and financial security. The unpredictable nature of today’s economy, combined with the unique challenges and opportunities of the digital space, makes investment an essential consideration for anyone earning income online.

Whether you’re a seasoned digital agency or just starting your freelance journey, it’s crucial to consider your investment strategy. From setting financial goals and understanding risk tolerance to diversifying investments and seeking professional advice, there’s a wide range of factors to consider.

Remember, the power of investment lies in its potential for compound growth and security. Even modest earnings, when consistently and wisely invested, can lead to substantial wealth over time. As you navigate the digital world, let your earnings work for you. By investing today, you are setting the stage for a financially secure and prosperous tomorrow.

To help you be successful, here’s a straightforward infographic to keep you focused on the right investment approach: